Integration Without the Chaos

Advisory, Program Management and Training for Mergers, Acquisitions and Organisational Transformation

~70% of mergers and business integrations fail to deliver on their objectives

McKinsey & Company, "Where Mergers Go Wrong"

Integrations and major business transformations often fail because they’re under-resourced, over-complicated, or managed by people who have never done it before.

MergeLogic provides corporate-grade advisory, practical execution, and tailored training programs to help your integration succeed, without the overhead or price tag of Big Consulting.

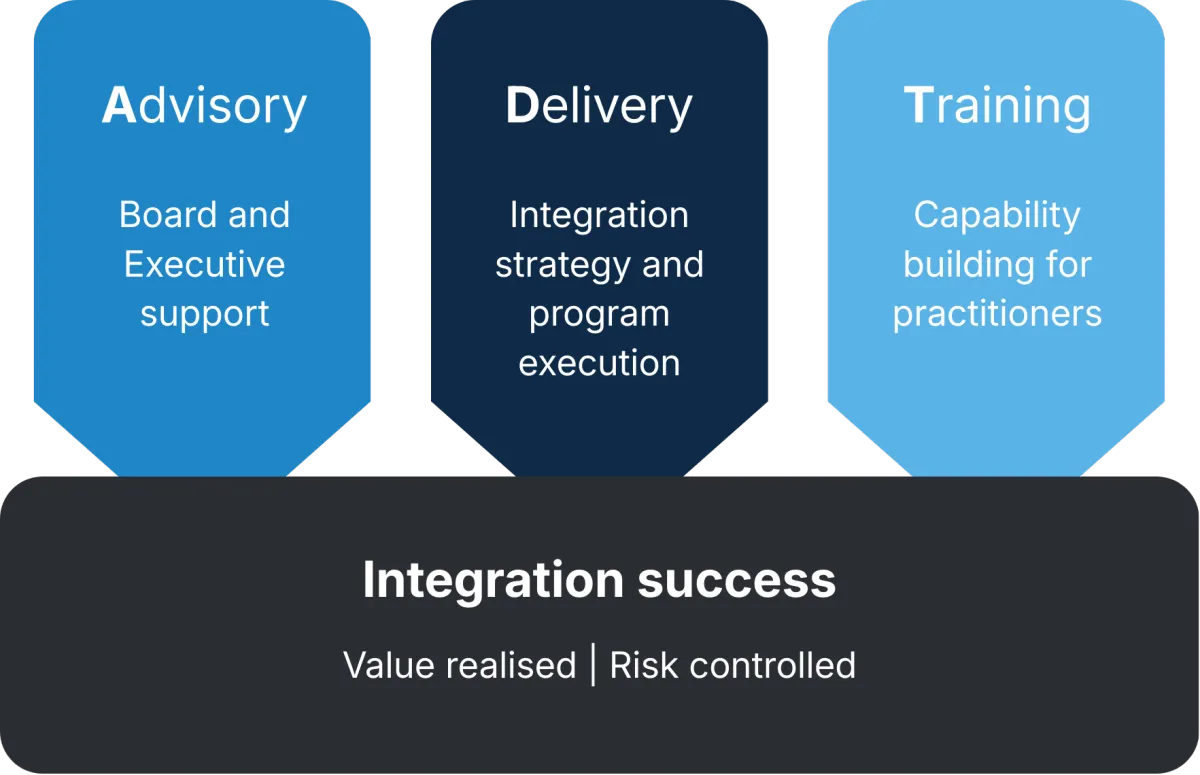

The ADT Service Model

MergeLogic offers three distinct integration service types that can be engaged independently or combined, depending on your objectives, risk profile, and internal capability.

Rather than a one-size-fits-all integration model, we tailor the right mix of advisory, delivery, and training support to suit each organisation’s needs, preferences, and constraints.

Advisory - Board and Executive-level guidance to de-risk integration decisions, manage complexity and maintain strategic focus.

Delivery - Dedicated integration strategy and program management support to execute critical initiatives on time and on budget.

Training - Targeted training and capability building for managers, program leaders and practitioners involved in integration activity.

Board and Executive Advisory Services

Independent insight. Real-world experience. No consulting baggage

MergeLogic provides discreet, expert advisory support to boards and executives who want confidence that their integration is on track commercially, operationally, and culturally.

Board advisory and steering committee participation

Pre-deal integration risk and readiness reviews

Executive alignment and strategy facilitation

Independent reviews and recovery planning

Integration Strategy and Program Management

Integration execution that actually delivers value.

When deals close, pressure builds fast. MergeLogic’s delivery services bring structure, momentum, and accountability through proven frameworks tailored to commercial realities.

Integration strategy and program design

PMO setup, governance and reporting

Cross-functional stream leadership (Finance, People, Operations, Technology, Sales & Marketing, Legal & Compliance)

Vendor and counterparty coordination and delivery assurance

Synergy delivery

Training and Capability Building

Build the skills to lead integration, not just survive it.

MergeLogic Training programs upskill teams and individuals in the practice of integration strategy and management, using tools and frameworks developed through 20+ years of corporate and consulting experience.

5-week practitioner course - "Integration by Design"

Guided by Design Thinking systems, Playing to Win strategy framework (Lafley & Martin), and best practice project management

Options for team workshops and individual coaching

Frequently Asked Questions

How is MergeLogic different from a traditional consulting firm?

MergeLogic is deliberately designed for the mid-market. We provide senior, hands-on integration expertise without the cost, bureaucracy, or generic playbooks that come with large consulting firms.

You work directly with an experienced integration practitioner, not a team of juniors and layers of client management, and engagements are scoped pragmatically around your objectives, constraints, and internal capability.

Do we need to engage all three services (Advisory, Delivery, and Train)?

No. The ADT model is modular by design.

Some clients engage MergeLogic purely in an advisory capacity at board or executive level. Others require delivery support for a defined integration program. Some invest in training to build internal capability ahead of, or alongside, an integration.

Services can be engaged independently, combined, or phased over time as needs evolve.

What types of integrations does MergeLogic support?

MergeLogic supports a broad range of integration scenarios, including:

- Post-merger and acquisition integrations

- Business unit, system, or operational integrations

- Organisational restructuring and operating model changes

- Pre-sale or pre-investment integration readiness

- Integration recovery or course correction

The common thread is complexity, risk, and the need for a clear strategy and disciplined execution.

At what stage of an acquisition or integration should we engage you?

MergeLogic can add value at multiple stages, including:

- Pre-deal: integration risk assessment, readiness reviews, and executive alignment

- Early post-close: integration strategy, governance, and program setup

- Mid-integration: delivery support, PMO leadership, or issue resolution

- Post-integration: optimisation, capability uplift, and lessons learned

Engagements are tailored to where you are now, not where a framework says you should be.

How are engagements typically structured and priced?

Engagements are structured to suit the nature of the work and the level of cost certainty required. This may include:

- Advisory retainers or time-based engagements

- Delivery support on a time & materials or deliverables basis

- Fixed-scope training programs for individuals or teams

The focus is on transparency, proportionality, and commercial alignment, not locking clients into unnecessary commitments.

Will MergeLogic replace our internal team or existing advisors?

No. MergeLogic is designed to complement, not displace, internal teams and existing advisors.

We often work alongside executives, functional leaders, legal advisors, corporate finance teams, or internal PMOs, providing specialist integration expertise, structure, and decision support where it is most valuable.

Who typically engages MergeLogic within an organisation?

MergeLogic engagements are typically sponsored by:

- Boards or board committees

- CEOs, CFOs, COOs, or transformation leaders

- Integration leads, program directors, or senior managers

- Business owners preparing for acquisition, merger, or investment

Training programs may also be sponsored as part of leadership development or capability uplift initiatives.

How do we know if MergeLogic is the right fit for us?

The simplest way is an initial discovery conversation.

This is a short, no-obligation discussion to understand your context, objectives, and constraints, and to determine whether MergeLogic is genuinely well-suited to support you.

If we’re not the right fit, we’ll tell you.

Testimonials

Dee Garnsworthy

CEO, Powershop

“Mike played a critical role in structuring and delivering the integration of the Powershop retail energy business into Shell Energy. He brought clarity and discipline to a highly complex program, coordinating senior stakeholders across Shell, Powershop and external partners while actively managing delivery risk. The integration was executed as planned and on schedule, with strong governance and control throughout"

Benjamin Goodall

CEO, PSC Insurance Brokers

"Mike played a key role in supporting the integration of PSC Insurance Brokers into Envest. He brought structure and discipline to a complex program while remaining pragmatic and respectful of the existing business and its people. His ability to manage

the interface with Envest, prioritise business-as-usual continuity, and keep the program focused on what mattered most was invaluable. The integration was delivered smoothly and without unnecessary disruption."

About MergeLogic

Expert independent integration expertise for complex change.

MergeLogic was founded to bridge the gap between large, transactional consulting firms and under-resourced internal integration teams.

After more than 20 years working across strategy, M&A, and complex transformation, it became clear that many integrations fail not because of poor intent, but because of a lack of structure, focus, and experienced leadership.

MergeLogic provides senior, independent integration support tailored to each organisation’s needs, bringing corporate-grade rigour without unnecessary complexity or overhead.

The business is led by Mike Percy, a former Chartered Accountant, and strategy and transformation consultant with experience across top-tier consulting and corporate environments, including Monitor Deloitte and Capgemini EY. Mike has led or supported integrations and transformation programs for organisations such as Shell, Commonwealth Bank, Allianz, BHP, Envest, RACQ and Macquarie Group, working across board advisory, program delivery, and hands-on execution.

What Makes Us Different

Senior-led, not leveraged.

You work directly with an experienced integration leader, not a rotating team of juniors.

Modular and pragmatic.

Advisory, delivery and training can be engaged independently or combined to suit your needs.

Focused on execution and outcomes.

Clear governance, practical decision-making and delivery discipline, not generic playbooks.

Designed for the mid-market.

Corporate-grade rigour without unnecessary complexity or cost.

Get In Touch